Personal financial management can be very stressful particularly when attempting to strike a balance between all of your expenses and your savings objectives. Nonetheless, the 50/30/20 rule is a straightforward budgeting technique that can guarantee financial stability and expedite the procedure. This guideline provides an easy-to-follow framework for classifying your income into three main categories: savings wants and needs. No matter your income level you can start to master your budget and take charge of your finances by following this rule.

Understanding the 50/30/20 Rule:

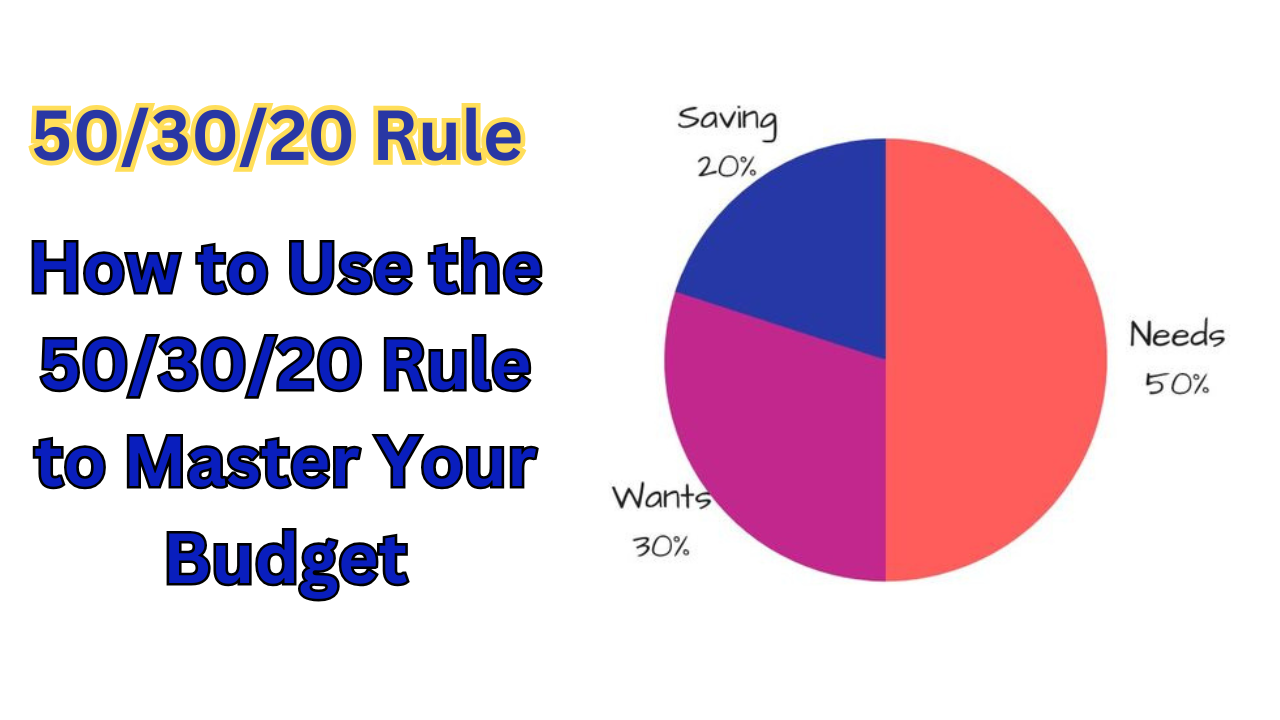

One well-known budgeting technique divides your post-tax income into three primary categories: the 50/30/20 rule. As per the rule, you should allocate 50% of your income to necessities 30% to wants and desires, and 20% to debt repayment and savings. This strategy offers a well-balanced framework to guarantee that you are fulfilling your short-term obligations and long-term financial objectives while maintaining flexibility and enjoyment in your spending plan.

Finding your after-tax income is a crucial first step in applying the 50/30/20 rule. After all taxes and deductions from your paycheck have been made this is the amount you keep home. Once you have this amount you can quickly divide your money using the percentages specified by the rule.

Allocating 50% to Needs:

The 50/30/20 rules first category needs to account for half of your post-tax income. The essential costs required to live and work are known as needs. These include expenses that are essential to day-to-day living such as utilities groceries rent or mortgage payments health insurance and transportation.

It is critical to distinguish between necessities and discretionary spending when figuring out what constitutes a need. Car insurance or the payment for a luxury car may fall more into the wants category whereas your car payment or the cost of public transportation for instance are regarded as necessities. Comparably necessities like basic health insurance or prescription drugs are needs whereas elective cosmetic procedures are wants.

Half of your income should go toward necessities but it’s also critical to periodically check your spending to make sure you’re not going overboard. By renegotiating your bills finding a more affordable place to live or choosing more economical options in the necessary categories you might be able to cut expenses.

Allocating 30% to Wants:

According to the 50/30/20 rule wants or 30% of your income come next. Wants are things that aren’t strictly necessary but make your life more comfortable and enjoyable. These can include things like eating out entertainment trips pastimes subscription services and high-end apparel or accessories.

The fact that this category is for discretionary spending should not be forgotten. Despite not being as necessary as your necessities these costs can nevertheless be beneficial to your enjoyment and general well-being. In order to avoid overspending and impulsive purchases the objective is to make sure that your spending on wants doesn’t go over the 30% limit.

Making decisions with awareness is necessary to manage your desires. For instance, think about cooking at home or looking into less expensive dining options instead of frequently dining at pricey restaurants. Additionally, you can cut down on subscription services to those that provide genuine value or move to more affordable options. Reducing non-essential spending can help you avoid needless financial strain but it doesn’t mean giving up enjoyment.

Allocating 20% to Savings and Debt Repayment:

Savings and debt repayment the last 50/30/20 rule category uses the final 20 percent of your income. Developing long-term financial security requires a strong foundation in this area. It covers emergency savings retirement funds savings account contributions and debt repayment.

The objective of setting aside 20% for savings is to prepare for your future financial objectives. Saving for significant life expenses like home ownership starting a family or schooling could entail contributing to an IRA or 401(k) retirement plan. You can accomplish these objectives more quickly if you set aside a specific amount of your income for savings.

This category covers savings as well as debt repayment including credit card balances personal loans and student loans. Setting debt repayment as a top priority is crucial to reaching financial freedom because paying off high-interest debts lessens your financial load and improves your overall stability. To increase your savings for the future you should set aside a specific amount of your 20% allotment for paying off high-interest debts.

How to Adjust the 50/30/20 Rule to Your Needs:

It may be necessary to modify the 50/30/20 rule to fit your unique financial circumstances even though it provides a good foundation for budgeting. For instance, it might be difficult to devote just 50% of your income to necessities if you reside in a place with high living expenses. In these circumstances, you might need to make a small adjustment to the percentages. Maybe for a brief period, you spend 60% of your income on necessities and less on savings or wants.

In a similar vein, you might decide to temporarily raise your savings allocation if you have a sizable debt load or are concentrating on creating an emergency fund. Some people would rather save more aggressively for short-term objectives like home ownership or loan repayment which might necessitate cutting back on discretionary spending or reevaluating their wants category.

Flexibility is essential for the 50/30/20 rule to be successful. It is critical to review your budget regularly and make changes as your situation evolves. The 50/30/20 rule will continue to work if you modify your budget to suit your present needs regardless of whether you’re having a brief financial setback or a windfall.

Conclusion:

Mastering your budget is essential to gaining financial security and independence. By using the 50/30/20 rule, you can create a balanced approach to managing your income and allocating your funds toward your most important financial priorities. Whether you’re saving for retirement, paying off debt, or simply trying to maintain a healthy budget, this rule provides a clear and actionable framework. By making smart decisions about your needs, wants, and savings, you’ll be better equipped to achieve your financial goals and build a secure future.